san francisco sales tax rate 2018

The California sales tax rate is currently. The California sales tax rate is currently.

State And Local Sales Tax Rates Sales Taxes Tax Foundation

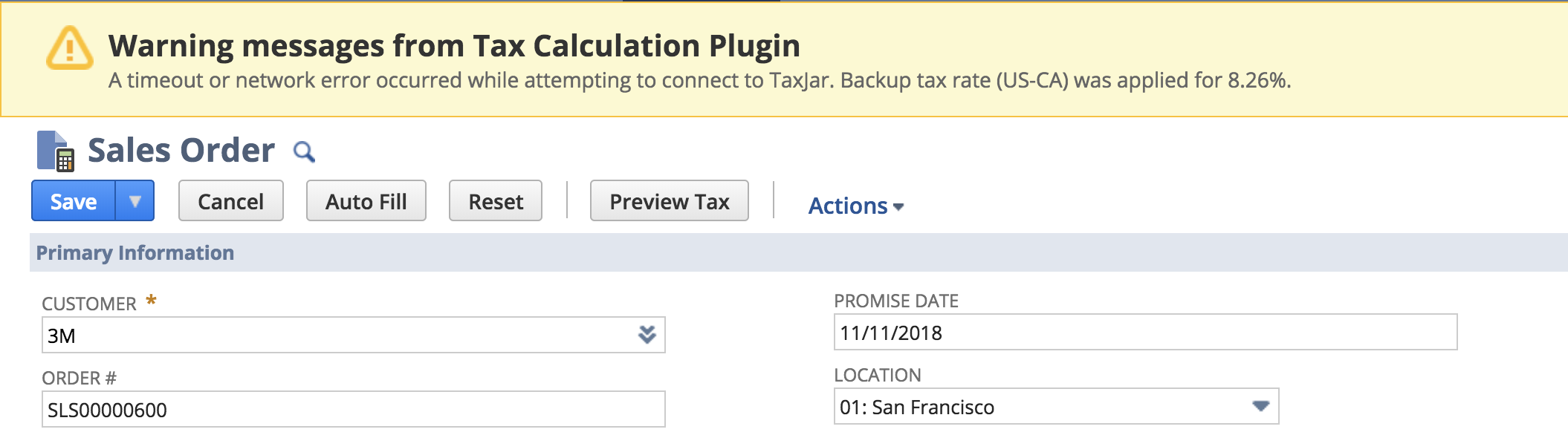

These online instructions provide a summary of the applicable rules to assist you with completing your 2018 return.

. The San Francisco County Sales Tax is 025 A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax. With local taxes the total sales tax rate is between 7250 and 10750. This rate is made up of 600 state sales tax rate and an.

There is no applicable city tax. Prior to the election maximum business tax rates on gross receipts in San Francisco ranged from 016 percent to 065 percent. The South San Francisco sales tax rate is.

California CA Sales Tax Rates by City S The state sales tax rate in California is 7250. The County sales tax rate is. Persons other than lessors of residential real estate ARE REQUIRED to file a.

Proposition C was designed to increase. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Blue Jay 7750 San Bernardino Blue Lake 7750 Humboldt. Did South Dakota v.

The statewide California sales tax rate is 725. California City and County Sales and Use Tax Rates. Please visit our State of Emergency Tax Relief page for additional information.

San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco CA is 8625. This is the total of state county and city sales tax rates. The San Francisco County sales tax rate is.

The California state sales tax rate is currently. The December 2020 total local sales tax rate was 8500. The statewide California sales tax rate is 725.

Next to city indicates incorporated city City Rate County Bolinas. The Basics of California State Sales Tax California sales tax rate. 3 Page Note.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. Rates Effective 04012018 through 06302018. The 2018 United States Supreme Court decision in South Dakota v.

Effective January 1 2017 the partial state tax exemption rate. Tax rates are provided by Avalara and updated monthly. Wayfair Inc affect California.

The County sales tax rate is. The statewide sales and use tax rate decrease of 025 percent affects certain partial state tax exemptions. The California state sales tax rate is currently.

The San Francisco sales tax rate is. Look up 2022 sales tax rates for San Francisco Colorado and surrounding areas. California City and County Sales and Use Tax Rates Rates Effective 07012018 through 09302018 1 P a g e Note.

The 2018 United States. Please visit our State of Emergency Tax Relief page for additional. Historical Tax Rates in California Cities Counties The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

Next to city indicates incorporated city City Rate County. A yes vote was a vote in favor of taxing marijuana businesses with gross receipts over 500000 at rates between 1 percent and 5 percent exempting retail sales of medical. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

United States Indirect Tax Guide Kpmg Global

04 16 2018 Will Online Merchants Have To Start Collecting Sales Tax Marketplace

Netsuite Sales Tax Integration Guide Taxjar Developers

Where Do Our Taxes Go Before Leaving California Consider The Facts Lifeguard Wealth Fee Only Financial Advisor In San Rafael Ca

America S Highest Earners And Their Taxes Revealed Propublica

Washington S Combined Average State Local Sales Tax Rate Of 8 92 Is Nation S 5th Highest California Has Highest State Rate Opportunity Washington

Frequently Asked Questions City Of Redwood City

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

![]()

Sales Tax In California Ballotpedia

National Overview Of Tnc Electrification Ev Shared Mobility

There S Still A Window Of Opportunity For San Francisco Condo Buyers Mansion Global

Why Identical Homes Can Have Different Property Tax Bills Lincoln Institute Of Land Policy

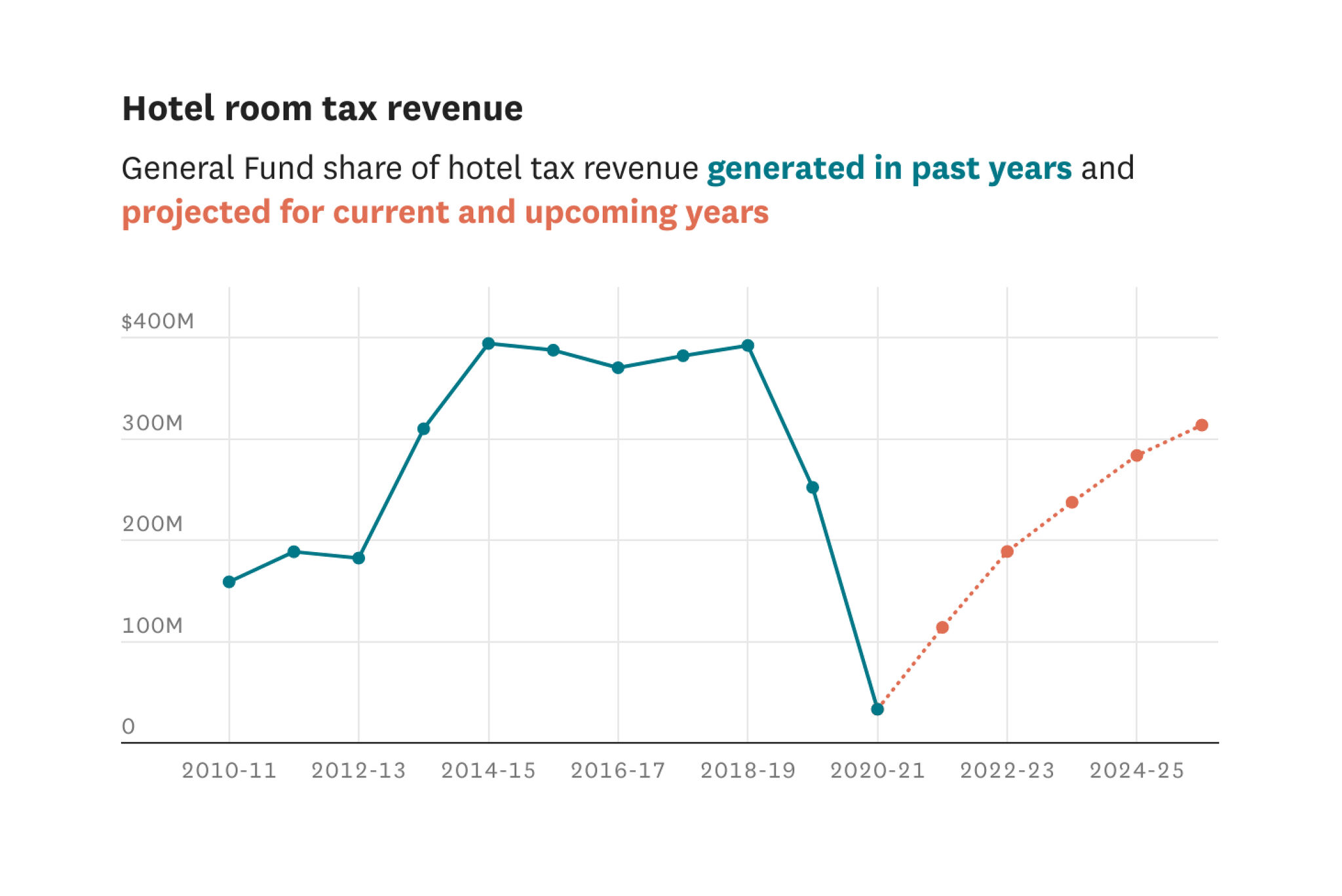

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

The Firm Has Forecasted Sales Of 7100000 And A Tax Rate Of 40 For 2018 Cost Of Course Hero

How Did Merck Record An 11 Tax Rate Last Year The Senate Finance Chairman Would Like To Know Fierce Pharma

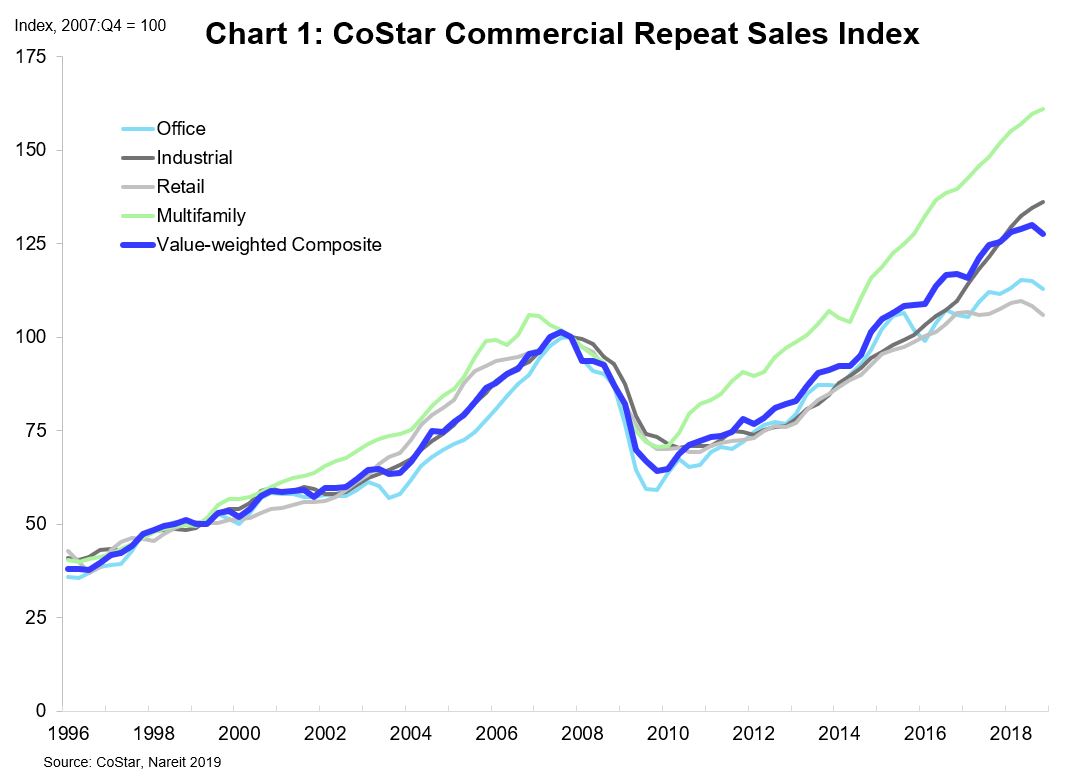

Commercial Property Prices Edged Higher In 2018 Nareit

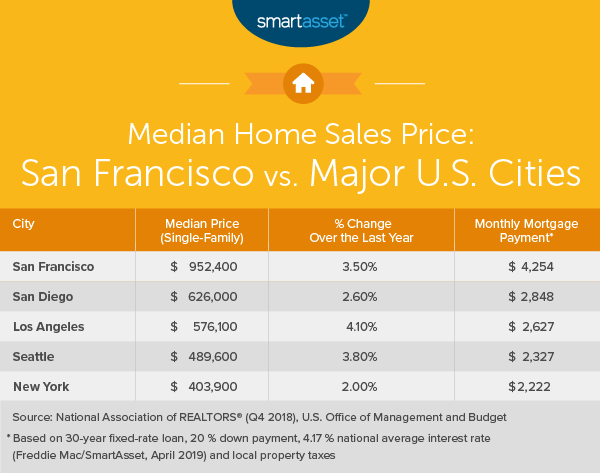

What Is The True Cost Of Living In San Francisco Smartasset

What Are San Francisco S Biggest Problems Here S What You Should Know

Local Taxes In Nyc And San Francisco Counties Are The 6 Highest In The Country Nowhere Else Even Comes Close Business Insider India